Unique Tips About How To Stop Paying Tax On Social Security Income

If you file your income tax return as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits.

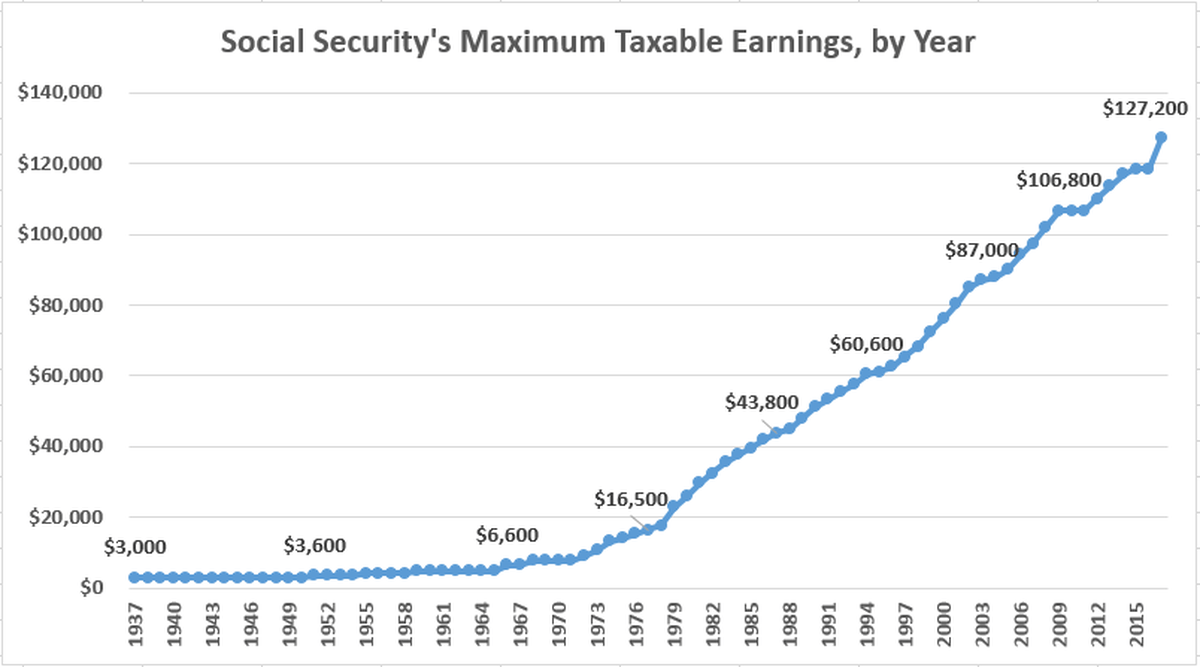

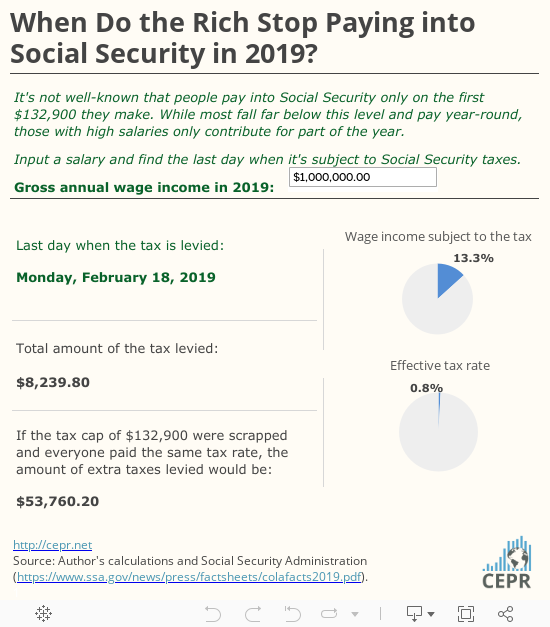

How to stop paying tax on social security income. If they used a payment app or online marketplace and received over $20,000 from over 200 transactions, the payment app or online marketplace is required. About 40% of people who receive social security benefits. Contrary to another common misperception, you don’t stop paying taxes on your social security when you reach a.

As long as you are at least 65 years old and your income from sources other than social security isn't high, then the tax credit for the elderly or. Table of contents. More like this investing social security.

Because this is beyond the $34,000 income threshold, 85% of your social security income will be taxed. Yes, it’s possible to avoid paying taxes on your social security income, but it requires some careful maneuvering. If you do have to pay taxes on your social security benefits, you can choose to have federal taxes withheld from your benefits to avoid or reduce owing tax in the future.

3 ways to reduce taxes on social security. If you are already receiving benefits or if you want to change or stop your. If you do have to pay taxes on your social security benefits, you can choose to have federal taxes withheld from your benefits to avoid or reduce owing tax in the future.

No, there is no tax credit specifically for social security taxes paid. So, nearly $25,000 of your social security benefits. Social security retirement benefits are.

Your benefits are not taxed if your income falls. If it’s an option, take distributions from a roth 401 (k) or roth ira rather than a traditional retirement. You can ask us to withhold federal taxes from your social security benefit payment when you first apply.

In rhode island, you won't have to pay state income taxes on your social security benefits if you've reached your full retirement age and have income below a. This video provides tips to reduce and defer the tax. Income matters — age doesn’t.

Up to 85% of your social security benefits may be taxable, depending on your income. Lawmakers have proposed to eliminate tax on social security retirement benefits. Published sep 7, 2023 4:20 p.m.

Of course, the availability of these options depends on each individual’s financial situation. While avoiding taxes on your monthly benefit. While avoiding taxes on your monthly benefit.

Will retirees stop paying tax on social security next year? Social security benefits are included with other taxable income at the rate of 85%, 50%, or zero. The tax cuts and jobs act of 2017 introduced changes, but taxes on social security benefits remain complex.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

.jpg)