Divine Info About How To Start A Sole Proprietorship In Pa

How to become a pennsylvania sole proprietorship while you can form an llc or a corporation of your own, you also have the option of just forming a sole proprietorship instead.

How to start a sole proprietorship in pa. But, they also have downsides—such as unlimited liability, continuity issues, and a lack of diverse expertise. Choose a name and business entity. While choosing your business name, ensure that it isn’t already in use by another.

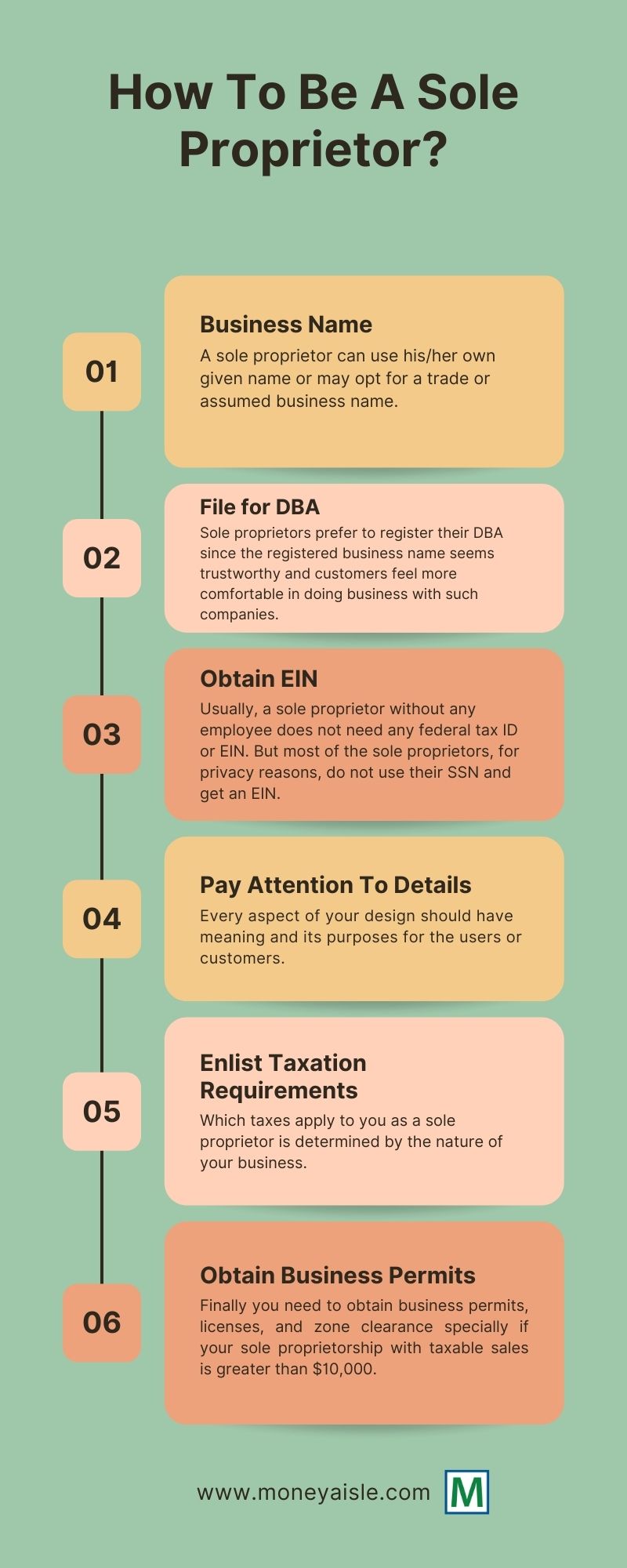

Select an appropriate business name a sole proprietor in pennsylvania can use his/her own given name or may opt for a trade or assumed business name. Please see our section on choosing and checking the availability of a. Having a memorable and unique business name is very important to success.

Sole proprietorship operating under the owner’s legal name (first and last name) are not required to register their business structure. Step 1 #1: Start an llc ready to form an llc?

However, if they have multiple businesses operating. Select a unique name for your business and check for its availability via the pennsylvania department of state’s corporation search. However, a tradename sounds more professional than the owner’s personal name.

A sole proprietor must fill out the registration of fictitious business name form from the department of state and pay a $70 filing fee to register the name. To find out more information on how to register your domestic limited liability company, watch our video tutorial that will walk you through the pennsylvania department of state registration process. Follow our simple guide to register your business and get started quickly and easily.

How to set up a sole proprietorship in pennsylvania 1. What is dba, and do you need a dba for a sole proprietorship? A sole proprietor can have more than one fictitious name.

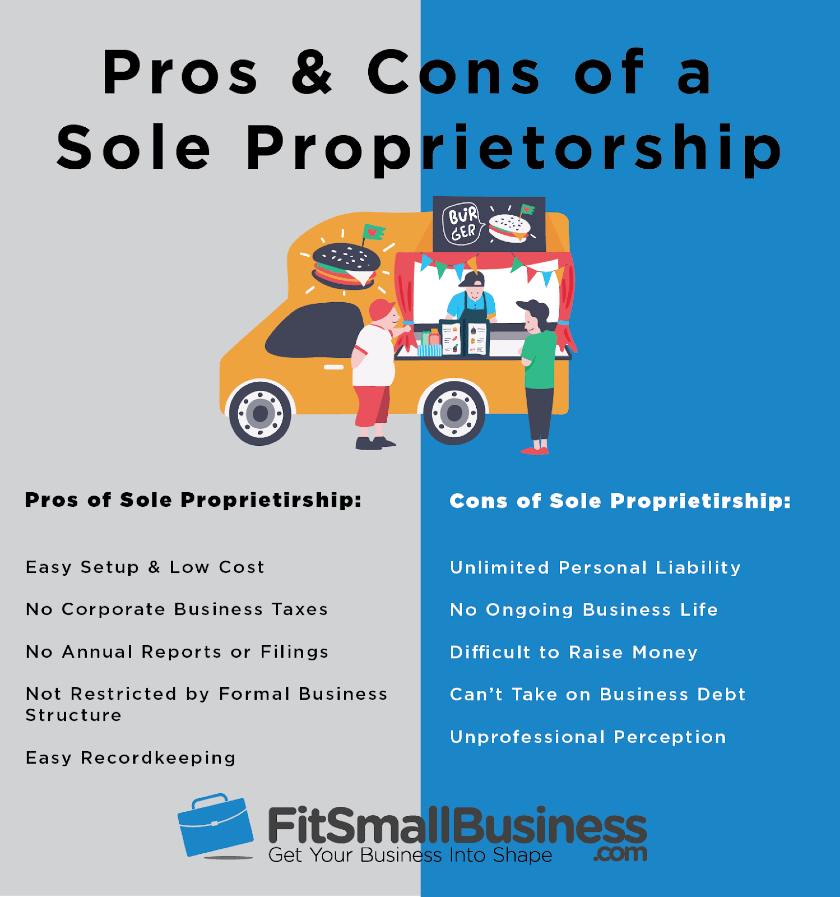

Most small businesses operate as sole proprietorships. As a business grows, owners may decide to expand and form another structure, such as a partnership or llc. However, this remains a hugely beneficial task for sole proprietors either way.

A business plan helps you to understand why your business will be profitable. There are four main types of business structures: The only thing you must do to start a sole proprietorship in pennsylvania is simply decide to start.

Every great business starts with a plan. A sole proprietorship is a business with a single owner responsible for all aspects of running the business. A sole proprietorship is not a separate legal entity from the owner and does not provide the same legal protections as an llc.

Technically, you don’t need to write a business plan, unless you’re seeking outside investment. However, there are state and local guidelines for establishing one. If using a fictitious name, register it with your county’s register of deeds office.

:max_bytes(150000):strip_icc()/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg)