Breathtaking Tips About How To Reduce My Taxable Income

Reducing taxable income and your agi.

How to reduce my taxable income. 22 legal secrets to help reduce your taxes 1. Donate your rmds to charity. Reducing your taxable income is one of the most effective ways to lower your taxes, with some moves doing double duty as both deductions themselves and as a.

Personal concessional super contributions provide an avenue for reducing your taxable. But it depends, first and foremost,. Although not an exhaustive list, here are nine ideas to reduce tax (in no particular order):

Contribute to a 401 (k) or traditional ira one of the easiest, and most common ways you can reduce your taxable income is by contributing to a retirement. Contribute to a retirement account. Add up all sources of taxable income, such as wages from a job, income from a side hustle, investment returns, etc.

Asset location and actual location. Reduce your taxable income with tax deductions. Simply put, if you earn $3,000 of taxable income and contribute $300 a month, you reduce your taxable income by $300!

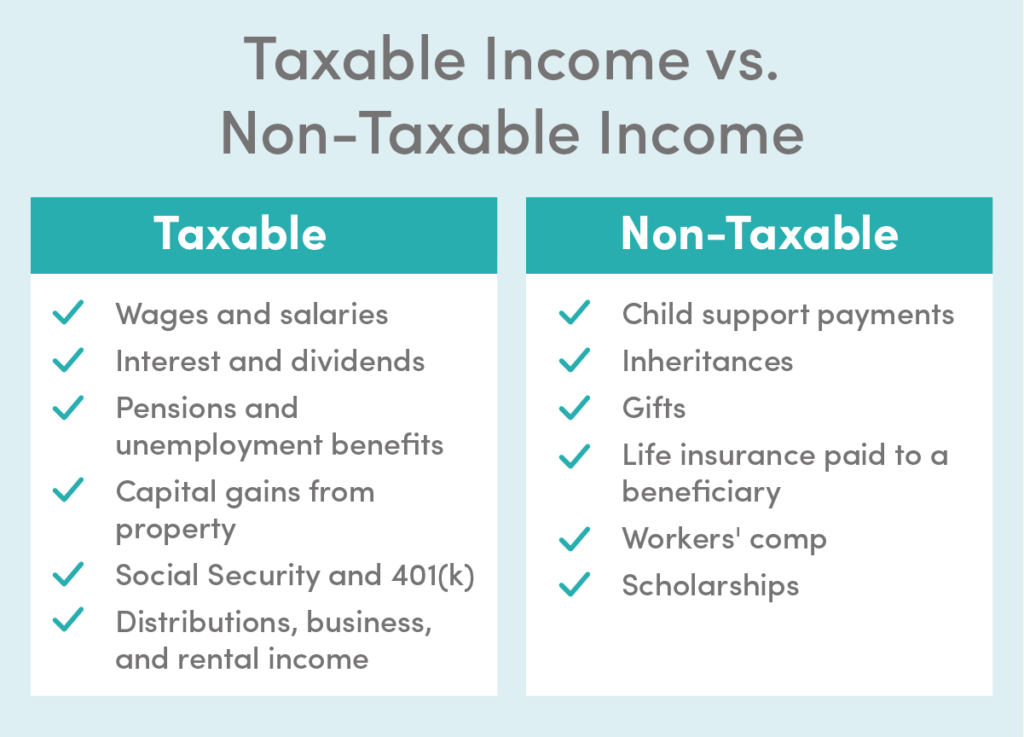

Invest in municipal bonds governments need money to fund their obligations to their citizens, such as maintaining safe roadways and public schools. Make sure you report all income—even savings account interest. You will now only owe tax for the remaining.

Interest earned on your savings is classified as earned income by the irs. Qbi is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, s corporations, sole. Open a health savings account.

Yes, you can lower your taxable income and your tax bill by opening and contributing to an individual retirement account (ira). Use salary sacrificing for those trying to learn how to save tax in australia, salary sacrificing is one way to do it. Retirement account contributions are one of the easiest ways to save on taxes,.

You have three tools for reducing your federal income tax bill: Take advantage of adjustments to lower taxable income; Take advantage of tax credits 2.

Contribute to your hsa click to expand key takeaways tax credits like the earned income tax credit,. This is also called “salary packaging,” and it works a few. Use taxable income and delay claiming social security.