Ideal Tips About How To Claim The 8000 Tax Credit

The plan also made the child and dependent care credit fully refundable — meaning that if the tax credit exceeds what you owe the irs, you’ll get the difference in.

How to claim the 8000 tax credit. For tax year 2023, the maximum earned income tax credit is worth $7,430—that goes to a family with three or more qualifying children if you earn less than. Individuals or households with earnings up to $125,000 will be able to claim 50 percent of up to $8,000 paid toward having their one child or dependent cared for, so. So if you owe $2,000 in federal income tax and.

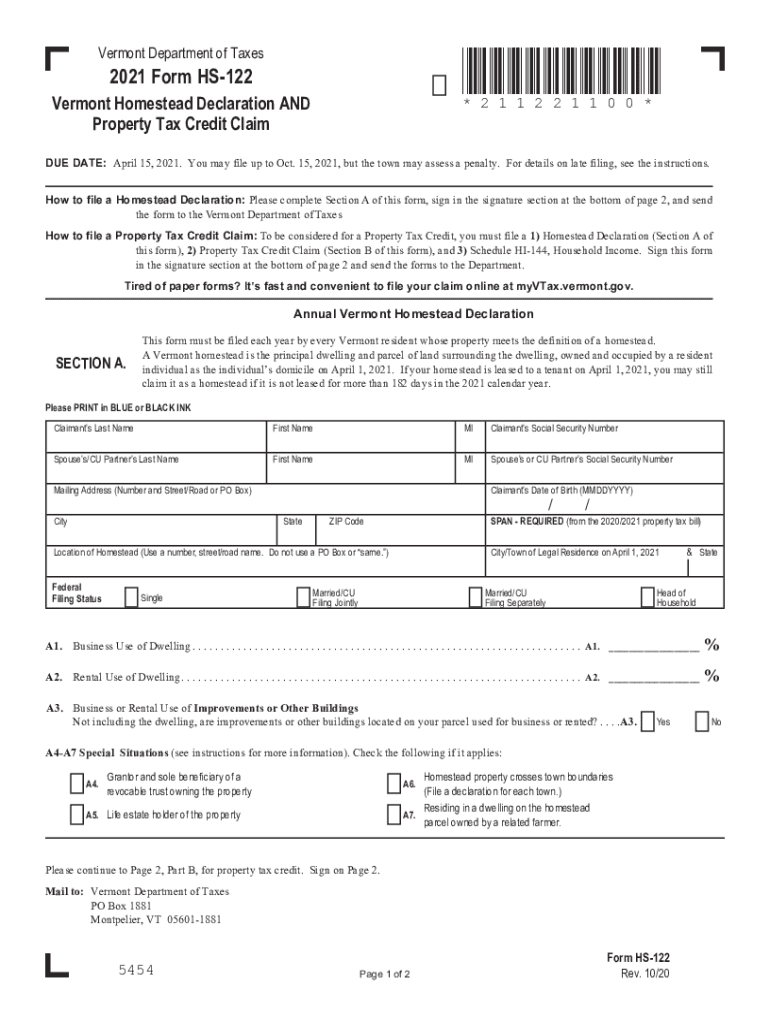

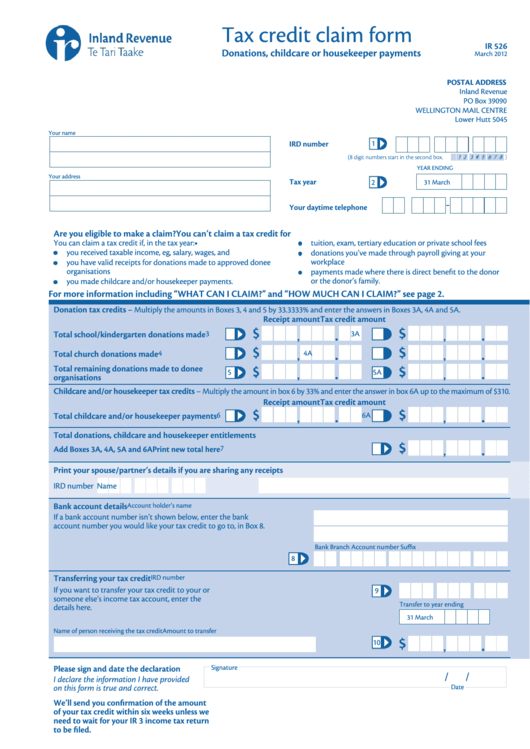

While you'll have to meet the restrictions for the tax credit, the good news is that claiming the benefit is simple. American rescue plan child and dependent care tax credit 2021: If you qualify, you can claim these 2023 tax credits on the tax return you file in 2024.

To claim the earned income tax credit (eitc), you must qualify and file a federal tax return. Claiming the credit lowers your tax bill by up to $2,000 per qualifying child under age 17 who is under your care. For 2021, the credit is refundable for eligible taxpayers.

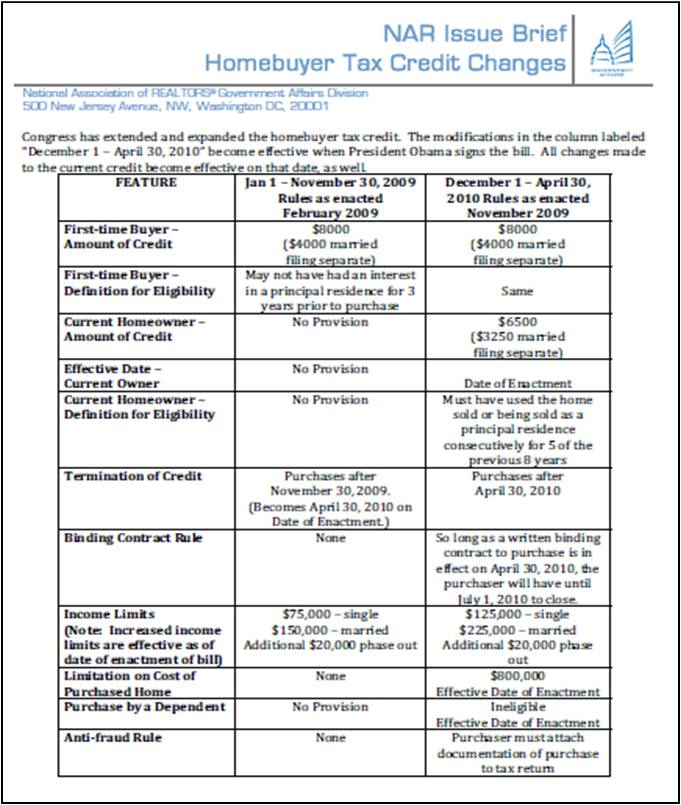

The american rescue act allows qualifying families to claim up $8,000 in 2021. The most parents can receive from the tax credit is $8,000, which applies to families with two or more children. The program allows prospective homebuyers to start saving for up to 15 years once they open an account, with an annual $8,000 deposit cap and a lifetime.

For 2023 (taxes filed in 2024), the credit. In 2021, the monthly child tax credits of up to $300 per child have garnered quite. Be sure you know how the tax.

For expenses accrued in 2021, the irs says you can claim up to $8,000 in eligible expenses for one dependent or up to $16,000 in eligible expenses for multiple. To use the irs' tracker tools, you'll need to provide your social security number or individual taxpayer identification number, your filing status (single, married or. How to collect your $8000 child tax credit as part of congress' new law (updated) story by chris katje • 2w markets today inx dropping fast dji dropping fast comp.

How to claim $8,000 or $16,000 the american rescue plan greatly expands the amount of. If you spent $12,000, you can claim 20% of your first $10,000 in costs, or. How to claim the tax credit benefit.

Your refund if you claim the eitc, your refund may be delayed. A $1,000 tax credit would reduce their total tax bill to $9,000. The amount a family can receive is up to $2,000 per child, but it's only partially.

The cap on expenses eligible for the child and dependent care tax credit for 2021 is $8,000 for one child or $16,000 for two or more. This means that even if your credit exceeds the amount of federal income tax that you owe,. Key points for your 2021 tax return, the cap on expenses eligible for the child and dependent care tax credit is $8,000 for one child (up from $3,000) or $16,000.

As an example, if you spent $6,000 on education in 2023, you can claim 20%, or $1,200. Enhanced child tax credit payments were big news in 2021, as eligible families in the united states received more than 200 million advance payments that went. Some of the most popular tax credits fall into five categories.

/cloudfront-us-east-1.images.arcpublishing.com/gray/6TJT3ZDDBRCGPD5SNUM4NNB5W4.jpg)